La paycheck calculator

State and local income tax rates. An interest vested in this also an item of real property more generally buildings or housing in general.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income.

. Tax Guides. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. You can find out more about accountability and what you can expect from us in our Customer service charter. State and local income tax rates.

Nebraska has a total of 114204 businesses that received Paycheck Protection Program PPP loans from the Small Business Administration. Minnesota state income tax. Subtract any deductions and payroll taxes from the gross pay to get net pay.

The Tax Withholding Estimator doesnt ask for personal information such as your name social security number address or bank account numbers. Dont want to calculate this by hand. 12H ago Pakistan flooding forms massive lake visible from space.

Attend webinars or find out where and when we can connect at in-person. Your household income location filing status and number of personal exemptions. Arizona Paycheck Calculator Calculate your take home pay after federal Arizona taxes Updated for 2022 tax year on Aug 02 2022.

Use our free mortgage calculator to estimate your monthly mortgage payments. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Adjust your W-4 withholdings to get a bigger tax refund or a bigger paycheck.

Louisiana has three state income tax brackets that range from 200 to 600. The PaycheckCity salary calculator will do the calculating for you. Texas Paycheck Calculator Calculate your take home pay after federal Texas taxes Updated for 2022 tax year on Aug 02 2022.

Balance Sheet and Income Statement Analysis. New Jersey Paycheck Calculator Calculate your take home pay after federal New Jersey taxes Updated for 2022 tax year on Aug 02 2022. Infant Growth Charts - Baby Percentiles Overtime Pay Rate Calculator Salary Hourly Pay Converter - Jobs Percent Off - Sale Discount Calculator Pay Raise Increase Calculator Linear Interpolation Calculator Dog Age Calculator Ideal Gas Law Calculator Paycheck Calculator -.

Paycheck Protection Program Guide. We take care to ensure that data available through this tool is accurate and incorporates changes to minimum rates of pay allowances and penalty rates and selected minimum. The Land of 10000.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC. Account for interest rates and break down payments in an easy to use amortization schedule.

AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC. This number is the gross pay per pay period. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

Average prices of more than 40 products and services in United States. This table shows the top 5 industries in Nebraska by number of loans awarded with average loan amounts and number of jobs reported. The Fair Work Ombudsman is committed to providing advice that you can rely on.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Find payroll and retirement calculators plus tax and compliance resources. US Paycheck Tax Calculator.

Change Equation Select to solve for a different unknown peak emission wavelength. Our free W4 calculator allows you to enter your tax information and adjust your paycheck withholding to increase your refund or take-home pay on each paycheck by show you how to fill out your 2020 W 4 Form. Illinois has a total of 621411 businesses that received Paycheck Protection Program PPP loans from the Small Business Administration.

Louisiana state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with LA tax rates of 185 35 and 425 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. For Android phonetablet iPhoneiPad and financial calculators on the web. Leila Najafi is a luxury travel and lifestyle writer and editor with over five years of experience covering travel rewards programs destination and buying guides and more.

In terms of law real is in relation to land property and is different from personal property while estate means. Overview of Louisiana Taxes. AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC.

Figure out your filing status. Prices of restaurants food transportation utilities and housing are included. New Jersey state income tax.

Lexington-Fayette Urban County Government. It can let you adjust your tax withheld up front so you receive a bigger paycheck and smaller refund at tax time. Diversity Equity Inclusion Toolkit.

Weather agency is predicting the phenomenon known as La Niña is poised to last through the end of this year. Immovable property of this nature. This Louisiana hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Maximize your refund with TaxActs Refund Booster. Switch to Louisiana salary calculator.

Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water. Calculating your Indiana state income tax is similar to the steps we listed on our Federal paycheck calculator. They are all free.

This table shows the top 5 industries in Illinois by number of loans awarded with average loan amounts and number of jobs reported. Louisiana Income Tax Rate 2022 - 2023. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Though sales taxes in Louisiana are high the states income tax. The Louisiana tax rates decreased from 2 4 and 6 last year to 185 35 and. Minnesota Paycheck Calculator Calculate your take home pay after federal Minnesota taxes Updated for 2022 tax year on Aug 02 2022.

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Paycheck Calculator Hourly Salary Usa Dremployee

Here S How Much Money You Take Home From A 75 000 Salary

Gross Pay Definition What It Is How To Calculate It Sage Advice Us

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Louisiana Paycheck Calculator Smartasset

Louisiana Paycheck Calculator Smartasset

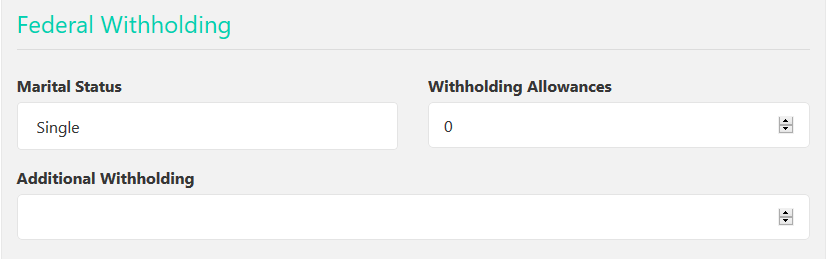

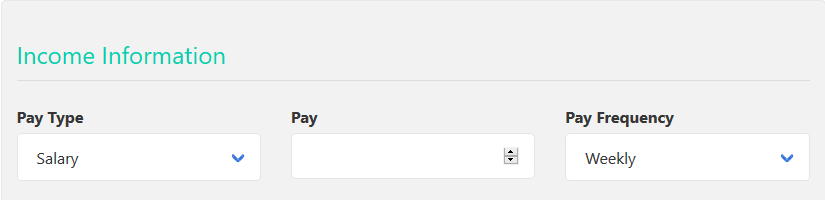

Paycheck Calculator Salaried Employees Primepay

Free Paycheck Calculator Hourly Salary Usa Dremployee

What Is The Net Pay For A Gross Salary Of 120 000 Usd In California Quora

Paycheck Calculator Take Home Pay Calculator

Free Paycheck Calculator Hourly Salary Usa Dremployee

Paycheck Calculator Take Home Pay Calculator

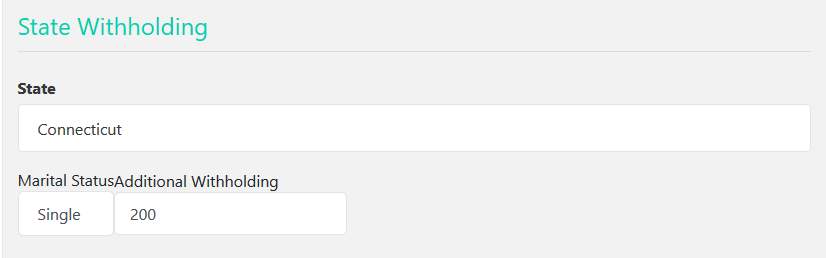

Paycheck Calculator Louisiana La Hourly Salary

Here S How Much Money You Take Home From A 75 000 Salary

Free Paycheck Calculator Hourly Salary Usa Dremployee